UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]x Filed by a Party other than the Registrant [_]

¨

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] CONFIDENTIAL, FOR USE OF THE

COMMISSION ONLY (AS PERMITTED BY

RULE 14A-6(E)(2))

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12

¨ | Preliminary Proxy Statement | |||

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||

¨ | Definitive Additional Materials | |||

¨ | Soliciting Material Pursuant to §240.14a-12 |

Host Marriott Corporation

- --------------------------------------------------------------------------------

(Name

(Name of Registrant as Specified In Its Charter)

- --------------------------------------------------------------------------------

(Name

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

-------------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

-------------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

-------------------------------------------------------------------------

(4) Proposed maximum aggregate value of transaction:

-------------------------------------------------------------------------

(5) Total fee paid:

-------------------------------------------------------------------------

[_] Fee paid previously with preliminary materials.

[_] Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

-------------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

-------------------------------------------------------------------------

(3) Filing Party:

-------------------------------------------------------------------------

(4) Date Filed:

-------------------------------------------------------------------------

Notes:

[LOGO] Host Marriott Corporation

10400 Fernwood Road

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

6903 Rockledge Drive, Suite 1500

Bethesda, Maryland 20817-1109

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

STOCKHOLDERS

TO BE HELD THURSDAY,TUESDAY, MAY 16, 2002

13, 2003

To Our Shareholders:

Stockholders:

You are cordially invited to attend the Annual Meeting of ShareholdersStockholders of Host Marriott Corporation, which will be held in Salon III at The Ritz-Carlton, Tysons Corner, located at 1700 Tysons Boulevard, McLean, Virginia, on Thursday,Tuesday, May 16, 200213, 2003 at 11:00 a.m. Doors to the meeting will open at 10:30 a.m. At the meeting, shareholdersstockholders will be asked to consider and vote on the following proposals:

Proposal 1: | Election of | |

Proposal 2: | Ratification of the appointment of KPMG LLP as independent auditors of the Company to serve for the 2003 calendar year; and | |

Proposal 3: | Consideration of a |

Stockholders will also transact other business if any is properly brought before the annual meeting.

If you were a shareholderstockholder of record at the close of business on March 29,

2002,26, 2003, you may vote at the annual meeting. Whether or not you plan to attend the meeting, please take the time to vote by completing and mailing the enclosed proxy card to us in the envelope provided.

This proxy statement provides you with detailed information about the proposals to be voted on at the meeting and the procedures for the meeting. WithIt also describes how the Company’s Board of Directors operates and gives certain information about the Company. Also included with this proxy statement we are also

including copiesis a copy of our 20012002 Annual Report to shareholders and our Form 10-K

for 2001 (collectively, the "Proxy Materials") in order to provide you with

additional information about us.Stockholders. We encourage you to read the proxy statement and the other informationannual report carefully.

By order of the Board of Directors,

/s/

/s/ ELIZABETH A. ABDOO

Elizabeth A. Abdoo

Elizabeth A. Abdoo

Corporate Secretary

April 5, 20027, 2003

Your vote is important to us. Please promptly complete, date, sign and return the enclosed proxy card whether or not you plan to attend the meeting.

Refer

Please refer to the note on the outsidereverse side of the back coverthis notice for information on accommodations and for directions to the hotel.

ANNUAL MEETING OF STOCKHOLDERS

OF HOST MARRIOTT CORPORATION

10400 Fernwood Road

Bethesda, Maryland 20817-1109

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 16, 2002

INFORMATION ABOUT THE ANNUAL MEETING

Our annual meeting

The 2003 Annual Meeting of Stockholders of Host Marriott Corporation will be held in Salon III at The Ritz-Carlton, Tysons Corner, located at 1700 Tysons Boulevard, McLean, Virginia, on Thursday,Tuesday, May 16, 200213, 2003, at 11:00 a.m. Doors to the meeting will open at 10:30 a.m. Please

refer

A special “Stockholder Annual Meeting” rate is offered at the hotel for Monday, May 12, 2003, the night before the meeting. A limited number of rooms are available for this special rate of $219, single or double occupancy. To receive this special rate, please call the hotel directly and ask for the Host Marriott Corporation “Stockholder Annual Meeting” rate for May 12. Applicable taxes and gratuities will be additional, and reservations are required in advance. This discount may not be used in conjunction with any other discount, coupon or group rate.

The Ritz-Carlton, Tysons Corner

1700 Tysons Boulevard

McLean, Virginia 22102

Telephone: (703) 506-4300

Directions to the outside back coverhotel:

From Ronald Reagan Washington National Airport:Take the George Washington Parkway north to I-495 South. Then exit on Tysons Corner/Route 123 South (Exit 11B). Turn right at the first light onto Tysons Boulevard. The Ritz-Carlton Hotel is on the left.

From Dulles International Airport:Take the Dulles Access Road East to Exit 17, Spring Hill Road. Please stay in the far right lane. After paying the toll, turn right onto Spring Hill Road and proceed straight through the traffic light. Spring Hill Road becomes International Drive. Turn left at the third light onto Tysons Boulevard. The Ritz-Carlton Hotel is on the right, next to the MCI Building.

West on I-66 from Downtown Washington, D.C.: Take I-66 West to Exit 67, I-495 toward Baltimore/Dulles. Then exit on Tysons Corner/Route 123 South, Exit 10A. Continue on Route 123 South, bearing right at the fourth light onto Tysons Boulevard. The Ritz-Carlton Hotel is on the left.

PROXY STATEMENT

Table of Contents

Page | ||

Attendance and Voting Matters | 1 | |

Proposal One—Election of Directors | 4 | |

Proposal Two—Ratification of Appointment of Independent Auditor | 6 | |

Proposal Three—Stockholder Proposal Regarding Annual Election of All Directors | 7 | |

The Board of Directors and Committees of the Board | 8 | |

Compensation of Directors | 11 | |

Security Ownership of Certain Beneficial Owners and Management | 12 | |

Executive Officer Compensation | 14 | |

Aggregated Stock Option/SAR Exercises and Year-End Value | 16 | |

Equity Compensation Plan Information | 17 | |

Employment Arrangements | 17 | |

Report of the Compensation Policy Committee on Executive Compensation | 19 | |

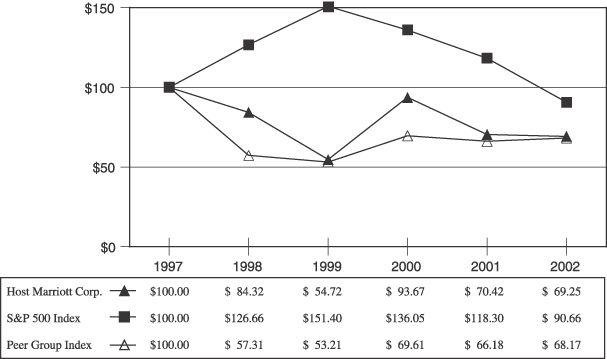

Performance Graph | 22 | |

Compensation Committee Interlocks and Insider Participation | 22 | |

Report of the Audit Committee | 23 | |

Auditor Fees | 25 | |

Certain Relationships and Related Transactions | 26 | |

Section 16(a) Beneficial Ownership Reporting Compliance | 28 | |

Stockholder Proposals and Director Nominations | 28 | |

Other Matters | 29 | |

Appendix A - Audit Committee Charter | A-1 |

HOST MARRIOTT CORPORATION

6903 Rockledge Drive, Suite 1500

Bethesda, Maryland 20817-1109

PROXY STATEMENT

ATTENDANCE AND VOTING MATTERS

Introduction

The annual meeting will be held on Tuesday, May 13, 2003, at 11:00 a.m. in Salon III at The Ritz-Carlton, Tysons Corner, located at 1700 Tysons Boulevard, McLean, Virginia. You are entitled to vote at our 2003 annual meeting because you were a stockholder at the close of business on March 26, 2003, the record date for this year’s annual meeting. That is why you were sent this proxy statement, forwhich contains information about the items to be voted upon at our annual stockholders meeting.

Q: What is a proxy?

A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. When you return the enclosed proxy card, you are giving us your permission to vote your shares of common stock at the annual meeting as you designate on accommodationsthe proxy card. The people who will vote your shares of common stock at the annual meeting are Christopher J. Nassetta and for directions to the hotel.

INFORMATION ABOUT THE PROXY STATEMENT

Our Board of Directors hasElizabeth A. Abdoo.

Q: What is a proxy statement?

We sent you this proxy statement and the enclosed proxy card because our Board of Directors is soliciting your proxy to solicitvote your voteshares at the annual meeting (including any adjournment or postponement of the

annual meeting). In thisstockholders meeting. This proxy statement we summarizesummarizes information that we are required to provide to you under the rules of the Securities and Exchange Commission, rules.

This proxy statementor SEC, when we ask you to sign a proxy. It is designed to assist you in voting.

Q: What does it mean if I get more than one proxy card?

You should vote on each proxy card you receive. You will receive separate proxy cards for all of the shares you hold in different ways, such as jointly with another person, or in trust, or in different brokerage accounts. If you hold shares in a stock brokerage account, you will receive a proxy card or information about other methods of voting from each broker, and you must send your shares. On April

5, 2002 we began mailingvote to your broker according to the Proxy Materials to all shareholders of record atbroker’s instructions.

Q: What may I vote on?

You may vote on the close of business on March 29, 2002.

PROPOSALS TO BE CONSIDERED BY YOU AT THE ANNUAL MEETING

At the annual meeting, we will ask you to:

following proposals

| (1) | Election of Robert M. Baylis, Ann McLaughlin Korologos and Terence C. Golden as directors for three-year terms expiring at the 2006 annual meeting and Judith A. McHale as a |

| (2) | the ratification of the appointment of KPMG LLP as independent auditors of the Company for 2003; |

| (3) | a |

| (4) | any other business as may properly come before the |

Q: Who is entitled to vote?

Anyone who owned common stock of the Company at the close of business on Wednesday, March 26, 2003, the record date, is entitled to vote at the annual meeting.

1

We are first sending the proxy solicitation materials, together with the Company’s 2002 Annual Report, on April 7, 2003 to all stockholders entitled to vote at the meeting.

Q: How do I vote?

You may vote your shares if you were a shareholder of record of our common stock as of the close of business on March 29, 2002. Each share is entitled to

one vote at the meeting. At the close of business on March 29, 2002, there were

264,561,792 shares of our common stock issued and outstanding. You may vote

your shares either by proxy or in person. You may vote in person as follows:

. By Proxy:by attending the annual meeting and voting in person. You can vote by proxy by completing, signing and dating the enclosed proxy card and returning it to us by mail in the envelope provided. The instructions for voting are contained on the enclosed proxy card. The individuals named on the card are your proxies. They will vote your shares as you indicate. If you sign your card without indicating how you wish to vote, all of your shares will be voted:

. FOR Mr. Schreiber as a Director;

. AGAINST the shareholder proposal regarding the annual election of

all Directors;

. AGAINST the shareholder proposal regarding the nomination process

for Directors;

. AGAINST the shareholder proposal regarding the re-incorporation of

the Company in Delaware from Maryland; and

.

| (1) | FOR the nominees as directors; |

| (2) | FOR the ratification of the appointment of KPMG LLP as independent auditors of the Company for 2003; |

| (3) | AGAINST the stockholder proposal regarding the annual election of all directors; and |

| (4) | at the discretion of your proxies on any other matters that may be properly brought before the annual meeting. |

Q: What if I return my proxy card and then change my mind?

You have the right to revoke your proxy at any time before the annual meeting.

. In Person: You may attend the annual meeting and vote in person.

You may revoke your proxy before it is voted at the meeting if you:

. file a written notice of revocation dated after the proxy date with

EquiServe Trust Company, N.A. (formerly First Chicago Trust Company of

New York), in its capacity as our transfer agent; or

. send EquiServe a later-dated proxy for the same shares of common stock;

or

. attend the annual meeting AND vote in person there.

| (1) | File a written notice of revocation dated after the proxy date with EquiServe Trust Company, N.A., or EquiServe (formerly First Chicago Trust Company of New York), in its capacity as our transfer agent; or |

| (2) | send EquiServe a later-dated proxy for the same shares of common stock; or |

| (3) | attend the annual meeting AND vote there in person. |

The mailing address for EquiServe is P.O. Box 8611, Edison, New Jersey 08818-9119.

If your

Q: How many shares of common stock may vote at the annual meeting?

At the close of business on March 26, 2003, there were 267,431,110 shares of our common stock issued and outstanding. Every stockholder is entitled to one vote for each share of common stock held.

Q: What vote is required to approve each proposal?

Directors are registeredelected by a plurality of the votes cast. Of all nominees, the top four in different namesterms of “for” votes received will be elected directors. Shares not voted will not affect the election of the directors except to the extent that failure to vote for an individual results in another individual’s receiving a larger proportion of votes.

The proposal to ratify the approval of KPMG LLP as independent auditors for 2003 will require approval by a majority of votes cast at the annual meeting.

Under our Articles of Incorporation, the stockholder proposal regarding the annual election of all directors must receive the affirmative vote of the holders of at least two-thirds of the total number of outstanding shares of our common stock as of the record date, March 26, 2003.

2

Q: What is a “quorum”?

A quorum is the presence at the annual meeting, in person or are in more than one

account, you will receive more than oneby proxy, card. To ensure that all your

shares are voted, please sign and return all proxy cards. We encourage you to

have all accounts registered in the same name and address, whenever possible.

You can accomplish this by contacting our transfer agent, EquiServe, at (800)

311-4816.

INFORMATION ABOUT A QUORUM

Holders of a majority of the outstanding shares of our common stock. Since there were 267,431,110 shares of common stock must be

presentoutstanding at the meeting, in person or by proxy, forclose of business on March 26, 2003, the presence of holders of 133,715,556 shares is a quorum. We must have a quorum to be present.conduct the meeting. If a quorum is not present or if we decide that more time is necessary for the solicitation of proxies, we may adjourn the annual meeting. We may do this with or without a shareholderstockholder vote. If there is a shareholderstockholder vote to adjourn, the named proxies will vote all shares of common stock for which they have voting authority in favor of adjournment.

Q: How are abstentions and broker non-votes treated?

Shares of our common stock represented by proxies that are marked "withhold

authority"“withhold authority” (with respect to the election of the nomineenominees for election as a Director)director), or marked "abstain,"“abstain,” or which constitute broker non-votes, will be counted as present at the meeting for the purpose of determining a quorum. Broker non-votes occur when a nominee holding shares of our common stock for a beneficial owner has not received voting instructions from the beneficial owner and such nominee does not possess or does not choose to exercise discretionary authority with respect to such shares.

With respect to any matter to be decided by a plurality (such as the election of a Director)director) or by a majority or by a supermajority, as the case may be, of the votes cast at the meeting, none of the proxies marked "withhold authority"“withhold authority” or marked "abstain,"“abstain,” or which constitute broker non-votes, will be counted for the purpose of determining the number of votes cast at the meeting.

VOTES NECESSARY FOR EACH PROPOSAL TO BE APPROVED

Proposal One: Election

Q: How will voting on any other business be conducted?

Although we do not know of Director--The person nominated for Director

receivingany other business to be considered at the most votes will be elected. Shares not voted will not affectannual meeting other than the election of directors and the Director exceptadditional proposals described in this proxy statement, if any other business is properly presented at the annual meeting, your signed proxy card gives authority to the extent that failureChristopher J. Nassetta and Elizabeth A. Abdoo, or either of them, to vote for an

individual results in another individual's receiving a larger proportion of

votes.

2

Proposal Two: Shareholder Proposal regarding the Annual Election of all

Directors--Under our Articles of Incorporation, the shareholder proposal urging

the Board of Directors to instate the annual election of all Directors must

receive the affirmative vote of the holders ofon such matters at least two-thirds of the total

number of outstanding shares of our common stock as of the record date.

Proposal Three: Shareholder Proposal regarding the Nomination Process for

Directors--Under our Articles of Incorporation, the shareholder proposal urging

the Board of Directors to nominate at least two candidates for each open

position on the Board must receive the affirmative vote of the holders of at

least two-thirds of the total number of outstanding shares of our common stock

as of the record date.

Proposal Four: Shareholder Proposal regarding the Re-incorporation of the

Company in Delaware from Maryland--Under our Articles of Incorporation, the

shareholder proposal urging the Board of Directors to take the measures

necessary to change the Company's jurisdiction of incorporation from Maryland

to Delaware must receive the affirmative vote of the holders of at least

two-thirds of the total number of outstanding shares of our common stock as of

the record date.

Other Matters--Unlesstheir discretion. Unless otherwise required by our Articles of Incorporation or Bylaws or by applicable Maryland law, any other matter properly presented for a vote at the meeting will require the affirmative vote from a majority of the shares of our common stock present and voting on such proposal.

COSTS OF PROXY SOLICITATION

The proxies being solicited by

Q: Who will count the votes?

Representatives of EquiServe, our transfer agent, will act as the inspectors of election and will tabulate the votes.

Q: Who pays the cost of this proxy statement are being solicited by

the Company. The Companysolicitation?

We will bear the entire cost of this proxy solicitation. We have retainedhired the firm of MacKenzie Partners, Inc., 156 Fifth Avenue, New York, New York 10010, to beassist in the solicitation of proxies on behalf of our proxy solicitation agentBoard. MacKenzie Partners has agreed to perform these services for a fee of $6,500, plus certain reimbursable expenses. Officers and regular employees of the Company may

solicit proxies by further mailing or personal conversations, or by telephone,

facsimile, telex or other electronic means. WeIn addition, we will, upon request, reimburse brokerage firms, banks and other nominees who hold our stock on behalf of other beneficial owners for their reasonable expenses related to forwarding our Proxy

Materialsproxy materials to those beneficial owners.

INFORMATION TO RELY UPON WHEN CASTING YOUR VOTE

You should rely only on the information contained in

Q: Is this proxy statement or incorporated by reference when voting onthe only way that proxies are being solicited?

No. In addition to mailing these matters. We have not

authorized anyone to give any information or to make any representation in

connection with this proxy solicitation materials, our officers and employees may solicit proxies by further mailings or personal conversations, or by telephone, facsimile, telex or other than those contained in or

incorporated by reference in this proxy statement. You should not rely on such

information or representation as having been authorized by us. You should not

infer under any circumstances that because this proxy statement has been

delivered to you, there has not been a change in the facts set forth in this

proxy statement or in our affairs since the date on this proxy statement.

electronic means.

3

PROPOSAL ONE: ELECTION OF DIRECTOR

One DirectorDIRECTORS

Four directors will be elected at the 2003 annual meeting of stockholders. Judith A. McHale is nominated for election as a Class I director to serve until the annual meeting of stockholders in 2005. Ms. McHale was approved by our Board of Directors in December 2002 annual meeting. John G. Schreiber

has been nominatedto fill a vacancy on our Board. Ms. McHale is required to stand for re-electionelection at thethis annual meeting to serve as a Directordirector until the 2005 annual meeting of shareholders.stockholders in 2005, when all Class I directors will stand for election. The other Class I Director is John G. Schreiber, who was re-elected last year.

In addition, Robert M. Baylis, Ann McLaughlin Korologos and Terence C. Golden are each nominated for election as Class II directors to serve until the annual meeting of stockholders in 2006. Mr. Schreiber is an

incumbent Director. Baylis, Ms. Korologos, and Mr. Golden are all currently directors of the Company.

The table below contains certain biographical information about himthe nominees for election as directors, as well as our other Directors. Hefor those directors continuing in office. Each nominee has consented to serve if re-elected, but should heany one be unavailable to serve (an event which our Board does not now anticipate), the proxies named on your proxy card will vote for the substitute nominee recommended by the Board of Directors.

Vote Required

The person nominated for Director who receives the most votes will be

elected.

The Board of Directors unanimously recommends that you vote FOR Mr. Schreiber as a

Director in Proposal One.

NOMINEEeach of the nominees for director.

NOMINEES FOR DIRECTOR

Robert M. Baylis Director since 1996 Age: 64

| Mr. Baylis is the retired Vice Chairman of CS First Boston. Prior to his retirement, he was Chairman and Chief Executive Officer of CS First Boston Pacific, Inc. Mr. Baylis is also a Director of New York Life Insurance Company, Covance, Inc., Gildan Activewear, Inc., and PartnerRe Ltd. In addition, he is an overseer of the University of Pennsylvania Museum, a Director of The International Forum, an executive education program of the Wharton School, and a member of the Advisory Council of the Economics Department of Princeton University. If elected as a director, Mr. Baylis’s term as a director would expire at the 2006 annual meeting of stockholders. | |

Terence C. Golden Director since 1995 Age: 58

| Mr. Golden served as our President and Chief Executive Officer from 1995 until his retirement in May 2000. He serves as Chairman of Bailey Capital Corporation. In addition, Mr. Golden is a director of Cousins Properties, Inc., Potomac Electric Power Company, and The Morris and Gwendolyn Cafritz Foundation. He is also Chairman of the Federal City Council. Prior to coming to Host Marriott, Mr. Golden had served as chief financial officer of The Oliver Carr Company and was a Founder and National Managing Partner of Trammel Crow Residential Companies. He was also a director of Prime Retail Inc. from 1994 to 2000. He has also served as Administrator of the U.S. General Services Administration and as Assistant Secretary of the U.S. Department of the Treasury from 1984 to 1985. If elected as a director, Mr. Golden’s term as a director would expire at the 2006 annual meeting of stockholders. |

4

Ann McLaughlin Korologos Director since 1993 Age: 61

| Ms. Korologos is Senior Advisor to Benedetto, Gartland & Company, Inc., an investment banking firm in New York, and is Vice Chairman of the Rand Board of Trustees. She formerly served as President of the Federal City Council from 1990 until 1995 and as Chairman of the Aspen Institute from 1996 until August 2000. Ms. Korologos has served with distinction in several United States Administrations in such positions as Secretary of Labor and Under Secretary of the Department of the Interior. She also serves as a Director of AMR Corporation, Fannie Mae, Kellogg Company, Microsoft Corporation, Vulcan Materials Company and Harman International Industries, Inc. If elected as a director, Ms. Korologos’ term as a director would expire at the 2006 annual meeting of stockholders. | |

Judith A. McHale Director since 2002 Age: 56

| Ms. McHale has been President and Chief Operating Officer of Discovery Communications, Inc., the parent company of cable television’s Discovery Channel since 1995. From 1989 to 1995, she served as Executive Vice President and General Counsel of Discovery Communications, Inc. Ms. McHale is also a Director of the John Hancock Financial Services Company, Polo Ralph Lauren Corporation and Potomac Electric Power Company. Ms McHale is Chair of the Board of Directors of Cable in the Classroom and also serves on the boards of the Children’s National Medical Center Campaign Trustees Group, the Honorary Advisory Council of the Children’s Inn at National Institute of Health, Vital Voices Global Partnership, The Africa Society, and Africare. If elected as a director, Ms. McHale’s term as a director would expire at the 2005 annual meeting of stockholders. |

OTHER DIRECTORS CURRENTLY IN OFFICE

Richard E. Marriott Chairman of the Board Director since 1979 Age: 64

| Mr. Richard E. Marriott is our Chairman of the Board. He is also a Director of the Polynesian Cultural Center and is Chairman of the Board of First Media Corporation. Mr. Marriott also serves on the Federal City Council, the Board of Associates for Gallaudet University and the National Advisory Council of Brigham Young University. He is a past President of the National Restaurant Association. In addition, Mr. Marriott is the President and a Trustee of the Marriott Foundation for People with Disabilities. Mr. Marriott’s term as a director expires at the 2004 annual meeting of stockholders. |

5

Christopher J. Nassetta President and Chief ExecutiveOfficer Director since 1999 Age: 40

| Mr. Nassetta is our President and Chief Executive Officer. He also serves as a Director of CoStar Group, Inc., as a Trustee of Prime Group Realty Trust and as a member of the McIntire School of Commerce Advisory Board for the University of Virginia. Mr. Nassetta joined our Company in 1995 as Executive Vice President and was elected our Chief Operating Officer in 1997. He became our President and Chief Executive Officer in May 2000. Prior to joining us, Mr. Nassetta served as President of Bailey Realty Corporation from 1991 until 1995, and he had previously served as Chief Development Officer and in various other positions with The Oliver Carr Company. Mr. Nassetta’s term as a director expires at the 2004 annual meeting of stockholders. | |

John G. Schreiber Director since 1998 Age: 56

| Mr. Schreiber is President of Centaur Capital Partners, Inc. and a |

Stockholder’s Supporting Statement

In support of the resolution, Mrs. Davis has submitted the following statement:

“The great majority of New York Stock Exchange listed corporations elect all their directors each year.

This insures that ALL directors will be more accountable to ALL stockholders each year and J.W.to a certain extent prevents the self-perpetuation of the Board.

Last year the owners of 71,493,455 shares, representing approximately 36.5% of shares voting, voted FOR my proposal.

If you AGREE, please mark your proxy FOR this proposal.”

Board of Directors’ Response

Mrs. Davis has submitted this proposal at the last seventeen annual meetings of stockholders, and it has been defeated on each occasion. The Board of Directors, as well as the Nominating and Corporate Governance Committee, has again considered the proposal and believes that the classified Board structure now in place continues to be in the best interests of the Company and its stockholders. For this reason, the Board of Directors again recommends that stockholders voteAGAINST the proposal.

Under the Company’s Articles of Incorporation, the Board is divided into three classes with directors elected to staggered three-year terms. Approximately one-third of the directors stand for election each year. This structure has been in place since it was approved by holders of 86% of our common stock in 1984 as an amendment to our then Certificate of Incorporation (as a Delaware company). In addition, at the special meeting of stockholders concerning the REIT conversion held in 1998, holders of more than 99% of the shares of our common stock voted to approve the transactions comprising the REIT conversion, including the adoption of our Articles of Incorporation for re-incorporation in Maryland. Those Articles of Incorporation similarly classify the Board of Directors into three classes, with one class being elected each year.

A classified board offers important advantages to stockholders and is the method of governance used by a majority of S&P 500 companies. Most notable among these advantages are increased stability, improved long-term planning and enhanced independence. The three-year staggered terms promote stability by ensuring that a majority of the Company’s directors at any given time will have had prior experience and familiarity with the business and affairs of the Company. Directors who have experience with the Company and knowledge about its business are a valuable resource and are better positioned to make the decisions that are best for the Company and its stockholders.

The Board also believes that electing directors to staggered three-year terms enhances long-term strategic planning. The continuity made possible by the classified structure is critical to the proper oversight of a company

7

like Host Marriott, Jr.which requires that investments in its properties be made over long periods of time. The annual election of only one-third of the Board also helps to prevent abrupt changes in corporate policies, based on misplaced short-term objectives, which might result if the entire Board could be replaced in one year.

Electing directors to three-year, as opposed to one-year, terms also enhances the independence of non-management directors by providing them with a longer assured term of office. By removing the threat of imminent removal, the Board believes that directors are brothers.

6

The Board of Directors also believes that directors elected to a classified Board are no less accountable to stockholders then they would be if all directors were elected annually. Since approximately one-third of the directors must stand for election each year, stockholders have the opportunity annually to withhold votes from directors as a way of expressing any dissatisfaction they may have with the Board or management. The Board notes that a majority of its directors are independent directors and only independent directors serve on the Audit Committee and the Compensation Policy Committee.

The Board also believes that a classified Board structure enhances the Board’s ability to negotiate the best results for stockholders should a takeover situation arise. A benefit of a classified Board is that it encourages a person seeking to obtain control of the Company to negotiate with the Board to reach terms that are fair and in the best interests of all stockholders. It does so by requiring two meetings of stockholders to replace a majority of the Board. This gives the incumbent directors the time and leverage necessary to evaluate the adequacy and fairness of any takeover proposal, negotiate on behalf of all stockholders, and study alternatives in order to maximize value for all stockholders. And although a classified Board enhances the ability to negotiate favorable terms with a proponent of an unfriendly or unsolicited proposal, it will not, in fact, prevent a person from accomplishing a hostile acquisition.

For these reasons, the Board believes that a classified Board is a better corporate governance vehicle than annual elections of Directors and unanimously recommends a vote AGAINST the proposal.

Vote Required

Under our Articles of Incorporation, approval of the proposed resolution requires the affirmative vote of the holders of at least two-thirds (66 2/3%) of the total number of outstanding shares of our common stock as of the annual meeting record date.

THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

Under the Company’s Articles of Incorporation, the Board is divided into three classes. One class is elected each year to serve for a three-year term. Presently, there are eight members on ourthe Board of Directors six of whom

currentlyhas seven members. There are neither officers nor employees of the Company.three Class II directors. Following the

death of our Director R. Theodore Ammon in October 2001, the Board reduced its

size from nine members to eight members. Our Board of Directors is currently

divided into the following three classes: Class I Directors, consisting of J.W.

Marriott, Jr., John G. Schreiber and Harry L. Vincent, Jr., will hold office

until the 2002 annual meeting of shareholders;stockholders, the board reduced its size from eight members to seven, thereby reducing the size of each of Class I and Class III to two directors in each class.

The directors whose terms expire at the 2003 annual meeting are the Class II Directors, consisting

ofdirectors, Robert M. Baylis, Terence C. Golden and Ann McLaughlin Korologos, will hold

officeKorologos. In addition, Ms. McHale, who was approved by our Board in December 2002 to fill a vacancy, is required to stand for election at this annual meeting to serve as a director until the 2003 annual meeting of shareholders; andstockholders in 2005, when all Class III Directors,

consisting of Richard E. Marriott and Christopher J. Nassetta,I directors will hold office

until the 2004 annual meeting of shareholders. Each Director serves for a term

of three years.

The Board has nominated John G. Schreiber for re-election at the 2002

annual meeting of shareholders. J.W. Marriott, Jr. and Harry L. Vincent, Jr.

have announced their intention not to stand for re-election at the end of their

current terms which expire at the 2002 annual meeting of shareholders.

Following the 2002 annual meeting of shareholders, the Board will reduce its

size from eight members to seven members, thereby reducing the size of Class I

to two Directors. This action will leave one vacancy on our Board of Directors

in Class I. The Board is currently engaged in a search to fill the vacancy.

Once the new Director has been elected by the remaining Board members to fill

the vacancy, the new Director will serve until the 2003 annual meeting of

shareholders. At that time, the shareholders will be asked to re-elect the new

Director for the remainder of the term of the Class I Directors, in addition to

electing the entire slate of Class II Directors.

election.

The Board met sixfour times in 2001.2002. Each Directordirector attended 75% or more of the meetings held during 2001.

2002.

8

The New York Stock Exchange has proposed rules that include a requirement that non-management directors meet at regularly scheduled executive sessions without management. The purpose is to promote open discussions among the non-management directors. The Board of Directors has already been following this practice, and in 2002 our non-management directors met in regularly scheduled executive sessions without the presence of members of the Company’s management after each Board meeting. In March 2003, the Board of Directors adopted Corporate Governance Guidelines, which formalized existing practice. Ann McLaughlin Korologos, as chair of the Nominating and Corporate Governance Committee, will serve as the presiding director at executive sessions in 2003. Interested parties may communicate their concerns regarding the Company directly with either the presiding director or the non-management directors as a group by writing to: Presiding Director, Host Marriott Corporation, 6903 Rockledge Drive, Suite 1500, Bethesda MD 20817, Attn: General Counsel.

Committees of the Board

The Board has established three standing committees: (i)committees to assist it in carrying out its responsibilities: the Audit Committee, (ii)the Compensation Policy Committee and (iii)the Nominating and Corporate Governance Committee. Each committee is composedconsists entirely of outside Directors.

Auditnon-employee directors and committee assignments are made in May, after the annual meeting of stockholders, by the Board, upon recommendation of the Nominating and Corporate Governance Committee. The Audit Committee:

. recommends the appointment of independent auditors to the Board of Directors;

. approves the scope of auditsDirectors may from time to time form other committees as circumstances warrant. Any new committees will have authority and other services to be performedresponsibility as delegated by the independent and internal auditors;

. considers whether the performanceBoard.

Audit Committee

Number of any professional service by the

auditors other than services provided in connection with the audit

function could impair the independence of the outside auditors;

. reviews the results of internal and external audits, the accounting

principles applied in financial reporting, and financial and

operational controls;

. meets with the independent auditors, management representatives and

internal auditors;

. meets as a committee at least four times a year;

. reviews interim financial statements each quarter before the Company

files its Quarterly Report on Form 10-Q with the Securities and

Exchange Commission; and

. reviews audited financial statements each year before the Company files

its Annual Report on Form 10-K with the Securities and Exchange

Commission.

The Audit Committee is composed of four Directors who are not our

employees. These Directors areMembers: three

Members: Robert M. Baylis (Chair), Ann McLaughlin Korologos and John G. Schreiber andSchreiber. Harry L. Vincent, Jr. R. Theodore Ammonwho retired as a director at the 2002 annual meeting of stockholders, also served onwas a member of the Audit Committee as its Chairman until his death in October

7

2001. The Board of Directors has determined that eachtime. Each member of the Audit Committee is, in the business judgment of the Board, independent and financially literate in accordance with paragraph

303meets the qualifications and expertise requirements of the New York Stock Exchange Listed Company Manual. The Board of

Directors has also determined that at least one memberExchange. Robert M. Baylis, the Committee’s Chairman, is, in the business judgment of the Audit Committee

has accountingBoard, an “audit committee financial expert” within the meaning of SEC rules.

Number of Meetings held in 2002: eight - Each committee member attended 75% or related financial management expertise. Themore of the meetings held during 2002 during the period when he or she was a member, except for Ms. Korologos, who attended over 60% of the meetings.

Functions:

| · | responsible for appointing the independent auditors; |

| · | approves the scope of audits and other services to be performed by the independent and internal auditors; |

| · | reviews and approves in advance all non-audit services and related fees and assesses whether the performance of non-audit service could impair the independence of the outside auditors; |

| · | reviews the results of internal and external audits, the accounting principles applied in financial reporting, and financial and operational controls; |

| · | meets with the independent auditors, management representatives and internal auditors; |

| · | reviews interim financial statements each quarter before the Company files its Quarterly Report on Form 10-Q with the SEC; and |

| · | reviews audited financial statements each year before the Company files its Annual Report on Form 10-K with the SEC. |

9

Our independent and internal auditors have unrestricted access to the Audit Committee. TheFor additional information on the responsibilities of the Audit Committee, met six timesplease refer to the Audit Committee charter attached as Appendix A to this proxy statement. The Report of the Audit Committee appears in 2001.this proxy statement at page 23.

Compensation Policy Committee

Number of Members: two

Members: John G. Schreiber (Chair) and Ann McLaughlin Korologos. Harry L. Vincent, who retired as a director at the 2002 annual meeting of stockholders, and Robert M. Baylis were also members of the Committee until May 2002. J. W. Marriott, Jr. served on the committee until January 2002.

Number of Meetings held in 2002: three - Each committee member attended all of the meetings held during 2002 during the period when he or she was a member.

Functions:

| · | oversees compensation policies and plans for officers and employees of the Company; |

| · | reflects the compensation philosophy in structuring compensation programs; |

| · | approves the compensation of senior officers of the Company; |

| · | advises our Board on the adoption of policies that govern the Company’s annual compensation and stock ownership plans; |

| · | reviews and approves the Company’s goals and objectives relevant to the compensation of the CEO and evaluates the CEO’s performance in light of those goals and objectives; |

| · | reviews and advises the Company on the process used for gathering information on the compensation paid by other similar businesses; |

| · | reviews the Company’s succession plans relating to the CEO and other senior management; and |

| · | reviews periodic reports from management on matters relating to the Company’s personnel appointments and practices. |

The Compensation Policy Committee’s Annual Report on Executive Compensation appears in this proxy statement at page 19.

Nominating and Corporate Governance Committee

Number of Members: three

Members: Ann McLaughlin Korologos (Chair), Robert M. Baylis, and Terence C. Golden. Harry L. Vincent and John G. Schreiber were also members of the Committee until May 2002.

Number of Meetings held in 2002: four - Each committee member attended 75% or more of the meetings held in 2001during 2002 during the period in which he or she was a member.

The Audit Committee has a written charter that incorporates provisions

relating to audit committees included in Securities and Exchange Commission

regulations and New York Stock Exchange rules. Among these provisions are

requirements that proxy statements include (i) an annual report of the Audit

Committee's finding with respect to its financial reporting oversight

responsibilities and (ii) a copy of the Audit Committee's charter at least once

every three years. The Audit Committee and the Board of Directors have reviewed

and assessed the adequacy of the Audit Committee's charter and the Board of

Directors has approved the Audit Committee charter. The Audit Committee's

annual report appears in this proxy statement at page 20.

Compensation Policy Committee. The Compensation Policy Committee

recommends policies and procedures relating to executive officers' compensation

and employee stock and cash incentive plans. It also approves individual salary

adjustments and stock awards in those areas. The Compensation Policy Committee

is composed of four Directors who are not our employees. These Directors are

John G. Schreiber (Chair), Robert M. Baylis, Ann McLaughlin Korologos and Harry

L. Vincent, Jr. R. Theodore Ammon also served on the Compensation Policy

Committee until his death in October 2001, and J.W. Marriott, Jr. served on the

Compensation Policy Committee until January 2002. The Compensation Policy

Committee met four times in 2001. Each member attended 75% or more of the

meetings held in 2001 during the period in which he or she was a member.

The Compensation Policy Committee's annual Report on Executive Compensation

appears in this proxy statement at page 15.

Nominating and Corporate Governance Committee. The Nominating and

Corporate Governance Committee:

. considers candidates for election as Directors;

. keeps abreast of and makes recommendations with respect to corporate

governance in general; and

. fulfills an advisory function with respect to a range of matters

affecting the Board of Directors and its committees, including the

making of recommendations with respect to:

. qualifications of Director candidates,

. compensation of Directors,

. the selection of committee chairs,

. committee assignments, and

. related matters affecting the functioning of the Board.

8

The Nominating and Corporate Governance Committee is composed of four

Directors who are not our employees. These Directors are Ann McLaughlin

Korologos (Chair), Robert M. Baylis, John G. Schreiber and Harry L. Vincent,

Jr. R. Theodore Ammon also served on the Nominating and Corporate Governance

Committee until his death in October 2001, and J.W. Marriott, Jr. served on the

Nominating and Corporate Governance Committee until January 2002. The

Nominating and Corporate Governance Committee met twice in 2001. Each member

attended both meetings, other than Mr. Ammon, who attended one meeting.

Functions:

| · | considers candidates for election as directors; |

| · | makes recommendations with respect to corporate governance matters and is responsible for keeping abreast of corporate governance developments; |

| · | fulfills an advisory function with respect to a range of matters affecting the Board and its committees, including making recommendations with respect to: |

| – | qualifications of director candidates; |

| – | compensation of directors; and |

| – | selection of committee chairs and committee assignments. |

10

The Nominating and Corporate Governance Committee will consider qualified nominees for Directordirector recommended by shareholders.stockholders. Recommendations must be submitted in writing to the Corporate Secretary and must include the name and address of the candidate, a brief biographical description of the candidate, a statement of the candidate'scandidate’s qualifications, and the candidate'scandidate’s signed consent to serve as a Directordirector if elected. See “Stockholder Proposals and Director Nominations” at page 28 of this proxy statement for additional information.

COMPENSATION OF DIRECTORS

Directors are compensated partially in cash and partially in our common stock to align their interests with those of our stockholders. Directors who are also our employees receive no additional compensation for their service as directors.

Annual Retainer and Attendance Fees. Directors who are not also our employees receive an annual retainer fee of $30,000, as well as an attendance fee of $1,250 for attendance at any stockholders’ meeting, meeting of the board of directors or meeting of a committee of the board of directors. If the director attends more than one meeting on a given day, an attendance fee is paid for each meeting. The chair of each committee of the Board receives an additional annual retainer fee of $6,000.

Annual Stock Awards. Under the Non-Employee Directors’ Deferred Stock Compensation Plan, directors who are not also our employees receive an annual award of common stock equivalents, which are converted into shares of our common stock only after a director stops serving on our Board. The annual award of such common stock equivalents is equal in value to the annual retainer fee (currently $30,000) paid to non-employee directors and is credited to such directors immediately following the annual meeting of stockholders. In 2002, each such award was for 2,575 common stock equivalents. The plan also permits participants to be credited with dividend equivalents that are equal in value to the dividends paid on our common stock.

Deferral of Payment. Directors may from timeelect to time formdefer payment of all or any portion of their annual retainer and attendance fees under our Executive Deferred Compensation Plan and/or our Non-Employee Directors’ Deferred Stock Compensation Plan. Fees that are deferred under the Non-Employee Directors’ Deferred Stock Compensation Plan are credited as common stock equivalents, which are then converted into shares of our common stock only after a director stops serving on our Board. The common stock equivalents are credited with dividend equivalents, which are equal in value to the dividends paid on our common stock.

Other. Directors are reimbursed for travel expenses and other committees as

circumstances warrant. Such committees will have authorityout-of-pocket costs incurred in attending meetings. Directors also receive complimentary rooms, food and responsibility

as delegatedbeverage and other hotel services when they stay at properties owned by us or managed by Marriott International, Inc. or its affiliates, and the Board.

9

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of our common stock and of the partnership units of Host Marriott, L.P. (which we call the operating partnership) that were beneficially owned as of February 28, 20022003 by:

. each Director and Director nominee;

. each executive officer named in the Summary Compensation Table below;

. all of our Directors and executive officers as a group; and

. beneficial owners of 5% or more of our common stock.

| · | each director and director nominee; |

| · | each executive officer named in the Summary Compensation Table below; |

| · | all of our directors and executive officers as a group; and |

| · | beneficial owners of 5% or more of our common stock. |

Information about the ownership of operating partnership units is included because the operating partnership units are redeemable by holders for cash or, at our election, for shares of our common stock on a one-for-one basis. The Company owns approximately 90% of the operating partnership units. As of February 28, 2002,2003, no other person or entity is the beneficial owner of 5% or more of the operating partnership units.

Name | Number of Shares of Common Stock | % of Shares of Common Stock(1) | Number of Operating Partnership Units | % of Common Stock and Operating Partnership Units(2) | ||||

Directors: | ||||||||

Robert M. Baylis(3) | 27,735 | * | 0 | * | ||||

Terence C. Golden(3) | 316,583 | 0.1 | 0 | 0.1 | ||||

Ann McLaughlin Korologos(3) | 14,691 | * | 0 | * | ||||

Richard E. Marriott(4) (5) (6) | 17,978,753 | 6.8 | 140,296 | 6.8 | ||||

Judith A. McHale | 0 | 0 | 0 | |||||

Christopher J. Nassetta(6) | 2,125,664 | 0.8 | 0 | 0.8 | ||||

John G. Schreiber(3) | 12,454 | * | 1,089,261 | 0.4 | ||||

Non-Director Executive Officers: | ||||||||

Robert E. Parsons, Jr.(6) (7) | 452,353 | 0.2 | 0 | 0.2 | ||||

James F. Risoleo(6) | 603,834 | 0.2 | 0 | 0.2 | ||||

W. Edward Walter(6) | 1,165,075 | 0.4 | 0 | 0.4 | ||||

All Directors and Executive Officers as a group | ||||||||

(15 persons, including the foregoing)(6) (7) | 23,195,936 | 8.8 | 1,229,557 | 9.2 | ||||

Certain Beneficial Owners: | ||||||||

J. W. Marriott, Jr. (4) (8) | 15,249,048 | 5.8 | 205,886 | 5.8 | ||||

Morgan Stanley Investment Management, Inc. (9) | 13,866,394 | 5.2 | 0 | 5.2 | ||||

Stichting Pensioenfonds ABP (10) | 22,149,300 | 8.4 | 0 | 8.4 | ||||

Wallace R. Weitz & Company (11) | 28,212,000 | 10.7 | 0 | 10.7 | ||||

Wellington Management Co., LLP (12) | 15,861,189 | 6.0 | 0 | 6.0 |

| * | Reflects ownership of |

| (1) | Any descriptions of |

| (2) | This column assumes that all operating partnership units held by the named person or group of persons are redeemed for shares of our common stock on a one-for-one basis, but that none of the operating partnership units held by others are redeemed for shares of our common stock. |

| (3) | The number of shares of our common stock listed here includes the common stock equivalents that are awarded annually to non-employee directors under our Non-Employee Directors’ Deferred Stock Compensation Plan, plus reinvested dividend equivalents relating thereto. |

12

| (4) | J.W. Marriott, Jr., Richard E. Marriott and other members of the Marriott family and various trusts and foundations established by members of the Marriott family owned beneficially an aggregate of 27,354,384 shares, or 10.4% of the total shares outstanding of our common stock, as of February 28, 2003. |

| (5) | The number of shares of our common stock listed here includes: (1) 1,866,439 shares held in trust for which Richard E. Marriott is the trustee or a co-trustee; (2) 75,364 shares held by the wife of Richard E. Marriott; (3) 603,828 shares held in trust for which the wife of Richard E. Marriott is the trustee or a co-trustee; (4) 4,974,849 shares held by the J. Willard and Alice S. Marriott Foundation, of which Richard E. Marriott is a co-trustee; (5) 492,689 shares held by the J. Willard Marriott, Sr. Charitable Trust, of which Richard E. Marriott is a co-trustee; (6) 63,623 shares held by the Alice S. Marriott Lifetime Trust, of which Richard E. Marriott is a co-trustee; (7) 1,515,300 shares held by the Richard E. and Nancy P. Marriott Foundation of which Richard E. Marriott is a co-trustee; and (8) 2,503,066 shares held by a corporation of which Richard E. Marriott is the controlling stockholder. It does not include shares held by the adult children of Richard E. Marriott; Richard E. Marriott disclaims beneficial ownership of all such shares. |

| (6) | The number of shares of our common stock listed here includes the shares of restricted stock granted under our 1997 Comprehensive Stock and |

| (7) | The number of shares of |

| (8) | Mr. J. W. Marriott, Jr. served as a member of our Board of Directors from 1964 until May 2002. The number of shares of our common stock listed here includes: (1) 1,606,750 shares held in trust for which J.W. Marriott, Jr. is the trustee or a co trustee; (2) 68,426 shares held by the wife of J.W. Marriott, Jr.; (3) 693,847 shares held in trust for which the wife of J.W. Marriott, Jr. is the trustee or a co-trustee; (4) 4,974,849 shares held by the J. Willard and Alice S. Marriott Foundation, of which J.W. Marriott, Jr. is a co-trustee; (5) 492,689 shares held by the J. Willard Marriott, Sr. Charitable Trust, of which J.W. Marriott, Jr. is a co-trustee; (6) 63,623 shares held by the Alice S. Marriott Lifetime Trust, of which J.W. Marriott, Jr. is a co-trustee; (7) 2,707,590 shares held by a limited partnership whose general partner is a corporation of which J.W. Marriott, Jr. is the controlling stockholder; and (8) 3,500,000 shares held by a limited partnership whose general partner is J.W. Marriott, Jr. This amount does not include shares held by the adult children of J.W. Marriott, Jr.; J.W. Marriott, Jr. disclaims beneficial ownership of all such shares. |

| (9) | The number of shares of our common stock listed here represents shares of our common stock held by Morgan Stanley Investment Management Inc. Morgan Stanley Investment Management Inc. has reported in a 13G filed with the Securities and Exchange Commission shared dispositive power over 13,866,394 shares of common stock and sole dispositive power over none of these shares. Of these shares, Morgan Stanley Investment Management Inc. has reported shared voting power over 11,515,720 shares and sole voting power over none of these shares. The principal address of Morgan Stanley Investment Management Inc. is 1221 Avenue of the Americas, New York, New York 10020. |

| (10) | The number of shares of our common stock listed here represents shares of our common stock held by Stichting Pensioenfonds ABP, an entity established under the laws of The Kingdom of the Netherlands, which invests funds on behalf of certain employees of The Kingdom of the Netherlands. Stichting Pensioenfonds ABP has reported in a 13D filed with the Securities and Exchange Commission sole dispositive power and sole voting power over the entire 22,149,300 shares. The principal business address of Stichting Pensioenfonds ABP was reported as: Oude Lindestratt 70, Postbus 2889, 6401 DL Heerlen, The Netherlands. |

| (11) | The number of shares of our common stock listed here represents shares of our common stock held by Wallace R. Weitz & |

| (12) | The number of shares of our common stock listed here represents shares of our common stock held by Wellington Management Company, LLP, which acts as an investment advisor for certain investment funds. Wellington Management Company, LLP has reported in a 13G filed with the Securities and Exchange Commission shared dipositive power of 15,861,189 shares and sole dispositive power over none of the shares. Of the shares, Wellington Management Company LLP has reported shared voting power over 12,880,200 shares and sole voting power over none of these shares. The principal business address of Wellington Management Company is 75 State Street, Boston, Massachusetts 02109. |

13

EXECUTIVE OFFICER COMPENSATION

Summary of Compensation

The table below sets forth a summary of the compensation we paid for the last three fiscal years to our Chief Executive Officer and to the four additional most highly compensated persons serving as executive officers at the end of our last fiscal year.

SUMMARY COMPENSATION TABLE

Annual Compensation | Long-Term Compensation | |||||||||||||||

Name and Principal Position | Fiscal Year | Salary(1) ($) | Bonus(2) ($) | Other Annual Compensation ($) | Restricted Stock Awards ($) | LTIP Payouts ($) | All Other Compensation(6) ($) | |||||||||

Richard E. Marriott | 2002 | 336,000 | 168,000 | 506,432 | (3) | 0 |

| 0 | 13,015 | |||||||

Chairman of the | 2001 | 336,000 | 84,000 | 320,878 | (3) | 0 |

| 0 | 16,821 | |||||||

Board | 2000 | 320,000 | 192,000 | 440,221 | (3) | 312,947 | (4) | 0 | 28,980 | |||||||

Christopher J. Nassetta | 2002 | 800,000 | 890,000 | 0 |

| 5,000,000 | (5) | 0 | 34,522 | |||||||

President and Chief | 2001 | 800,000 | 350,720 | 0 |

| 0 |

| 0 | 47,696 | |||||||

Executive Officer | 2000 | 624,584 | 794,684 | 0 |

| 2,586,763 | (4) | 0 | 69,271 | |||||||

W. Edward Walter | 2002 | 467,250 | 478,371 | 0 |

| 2,000,000 | (5) | 0 | 20,362 | |||||||

Executive Vice | 2001 | 429,810 | 211,466 | 0 |

| 764,902 | (4) | 0 | 23,192 | |||||||

President and Chief | 2000 | 330,209 | 348,300 | 0 |

| 1,506,058 | (4) | 0 | 30,625 | |||||||

Financial Officer | ||||||||||||||||

Robert E. Parsons, Jr. | 2002 | 467,250 | 465,007 | 0 |

| 500,000 | (5) | 0 | 20,533 | |||||||

Executive Vice | 2001 | 467,250 | 217,178 | 0 |

| 0 |

| 0 | 30,012 | |||||||

President, | 2000 | 445,000 | 534,000 | 0 |

| 812,991 | (4) | 0 | 53,995 | |||||||

Special Projects | ||||||||||||||||

James F. Risoleo | 2002 | 365,000 | 367,300 | 0 |

| 400,000 | (5) | 0 | 15,842 | |||||||

Executive Vice | 2001 | 346,233 | 163,076 | 0 |

| 399,900 | (4) | 0 | 13,587 | |||||||

President, Acquisitions | 2000 | 279,296 | 296,000 | 0 |

| 990,704 | (4) | 0 | 33,546 | |||||||

and Development | ||||||||||||||||

| (1) | Salary amounts include base salary earned and |

| (2) | The bonus consists of the cash bonus earned pursuant to the performance criteria for annual incentive awards established by our Compensation Policy Committee. It was either paid subsequent to the end of each fiscal year or deferred under the Executive Deferred Compensation Plan. |

| (3) | The amounts set forth in this column for Mr. Marriott include $194,885, $132,150 and $125,100 in 2002, 2001 and 2000, |

| (4) | The Company’s long-term incentive stock awards are generally made as a multi-year grant that vests over a three-year period based on achievement of performance criteria and continued employment over the period. Although it is a multi-year grant and portions may not ultimately be earned, the Company reflects the total value of the award in the year it was authorized. The Company authorized such a grant in 1998 for a three-year program covering 1999-2001, and the value of the grant was reported in 1998. For 1999, |

14

reflected his promotion to Chief Executive Officer and President. In 2001, |

Total Shares Available 2000–2002 | Total Shares Vested | Total Shares Forfeited | |||||

Mr. Marriott | 170,173 |

| 110,613 | 59,560 | |||

Mr. Nassetta | 810,000 |

| 512,500 | 297,500 | |||

Mr. Walter | 467,382 | * | 298,705 | 168,677 | |||

Mr. Parsons | 522,817 |

| 339,831 | 182,986 | |||

Mr. Risoleo | 265,000 | * | 168,749 | 96,251 | |||

| * | For Messrs. Walter and Risoleo, the total shares available amount for 2000—2002 reflects the additional allocation of shares in 2001. |

| (5) | This is the market value of restricted stock awards to Messrs. Nassetta, Walter, Parsons and Risoleo on August 1, 2002, the date on which the shares were granted. The shares of restricted stock were granted to these executives in recognition of the work performed in positioning and restructuring the Company leading up to and after the events of September 11, 2001 |

| (6) | This column represents our matching contributions made under our Retirement and Savings Plan and our Executive |

15

AGGREGATED STOCK OPTION/SAR Exercises and Year-End Value

EXERCISES AND YEAR-END VALUE

The table below sets forth, on an aggregated basis:

. information regarding the exercise of options to purchase our common

stock (and shares of common stock of Marriott International, Inc.,

which we have previously spun off) by each of the named executive

officers listed above on the Summary Compensation Table;

. information regarding the exercise of stock appreciation rights

("SARs") in our common stock by each of the named executive officers

listed above on the Summary Compensation Table; and

. the value on December 31, 2001 of all unexercised options and stock

appreciation rights held by such individuals.

Christopher J.

| · | information regarding the exercise of options to purchase our common stock (and shares of common stock of Marriott International, Inc., which we have previously spun off) by each of the named executive officers listed above on the Summary Compensation Table; |

| · | information regarding the exercise of stock appreciation rights (SARs) in our common stock by each of the named executive officers listed above on the Summary Compensation Table; and |

| · | the value on December 31, 2002 of all unexercised options and SARs held by such individuals. |

Messrs. Nassetta, W. Edward Walter and James F. Risoleo do not have any options to purchase stock or SARs in either of the companies listed in the following table. Richard E. Marriott is the only executive officer who holds stock appreciation rights in our common stock. In 1998, Mr. Marriott entered into an agreement with our Company which canceled all of his then outstanding options to purchase our common stock and replaced them with stock appreciation rights on equivalent economic terms.

AGGREGATED STOCK OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FISCAL

YEAR-END OPTIONOPTION/SAR VALUES

Name | Company(1) | Shares Acquired on Exercise (#) | Value Realized ($) | Number of Shares Underlying Unexercised Options/SARs at Fiscal Year End(2) (#) | Value of Unexercised In-the-Money Options/SARs at Fiscal Year End(3) ($) | |||||||||

Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

Richard E. Marriott | HM | 0 | 0 | 66,685 | 0 | 459,002 | 0 | |||||||

MI | 0 | 0 | 122,634 | 0 | 3,429,314 | 0 | ||||||||

TOTAL | 0 | 0 | 189,319 | 0 | 3,888,316 | 0 | ||||||||

Robert E. Parsons, Jr. | HM | 0 | 0 | 14,637 | 0 | 98,849 | 0 | |||||||

TOTAL | 0 | 0 | 14,637 | 0 | 98,849 | 0 | ||||||||

| (1) | “HM” represents options to purchase our common stock or SARs in our common stock. “MI” represents options to purchase Marriott International, Inc. common stock. |

| (2) | The number and terms of |

| (3) | These figures are based on a per share price for our common stock of $8.77 and a per share price for Marriott International, Inc. common stock of $33.02. These prices reflect the average of the high and low trading prices on the New York Stock Exchange on December 31, 2002. |

16

EQUITY COMPENSATION PLAN INFORMATION

(as of December 31, 2002)

Plan Category | Number of securities (in millions) to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities (in millions) remaining available for future issuance under equity compensation plans (excluding securities reflected in the 1st column) | |||

Equity compensation plans approved by security holders(1) | 5.4 | $6.50 | 14.9 | |||

Equity compensation plans not approved by security holders | 0 ________ | 0 ________ | 0 ________ | |||

TOTAL | 5.4 ________ | $6.50 ________ | 14.9 ________ |

| (1) | Shares indicated are the aggregate of those issuable under the Host Marriott Corporation and Host Marriott, L.P. 1997 Comprehensive Stock and Cash Incentive Plan, as amended, whereby we may award to officers and key employees (i) options to purchase our common stock, (ii) deferred shares of our common stock, and (iii) restricted shares of our common stock. |

EMPLOYMENT ARRANGEMENTS

We do not maintain employment agreements with any of our executive officers.

Split-Dollar Life Insurance

The Company maintains split-dollar life insurance agreements with the REM Insurance Trust, a trust established by Richard E. Marriott, our Chairman of the Board. Under those agreements, the Trust has acquired life insurance policies on behalf of Mr. Marriott and his wife, Nancy Marriott. The Company pays certain premiums in connection with those policies and is entitled to be repaid all premiums from the death benefit or the cash surrender value of the options.

(3) These figures arepolicy. This repayment obligation is secured by an assignment of an interest in the policies from the Trust to the Company.

This split-dollar program was put in place in exchange for the termination of Mr. Marriott’s accrued interest, as of November 30, 1996, in awards of deferred bonus stock to him under The Host Marriott Corporation 1993 Comprehensive Stock Incentive Plan.

Host Marriott reports taxable income to Mr. Marriott on an annual basis, the amount of income being determined based on a per share price for our common stock of $9.26

and a per share price for Marriott International, Inc. common stock of

$40.96. These prices reflect the averagevalue of the highlife insurance coverage in force insuring the life of Mr. and low trading prices

on the New York Stock Exchange on December 31, 2001.

14

EMPLOYMENT ARRANGEMENTS

Our written "Key Executives/Termination of Employment" policy governs

certain terms and conditionsMrs. Marriott. No premiums were paid for 2002, however, pending clarification of the employmentcontinued use of our executive officers,

including all of those executive officers named insplit-dollar life insurance policies following the Summary Compensation

Table above. The termspassage of the policy are subject toSarbanes-Oxley Act of 2002.

Severance Plan

The Compensation Policy Committee recently approved the approvaladoption of the Host Marriott Severance Plan for members of senior management, including Messrs. Nassetta, Walter and Risoleo. Our Chairman of the Board, Mr. Marriott, is not covered by the plan. The plan provides for the payment of Directorsseverance compensation upon termination as follows:

| · | Termination for Cause: an executive terminated for cause receives no severance and forfeits any unvested long-term incentive stock compensation; |

17

| · | Termination as a Result of Death or Disability: upon death or disability an executive receives a prorated annual bonus through the month of death or disability and all long-term incentive stock compensation vests. In addition, the executive would be entitled to benefits under the Company’s life insurance and disability plans applicable to all employees. The Company has purchased life insurance with respect to each of Messrs. Nassetta, Walter, and Risoleo to fund the cost to the Company of the long-term incentive stock compensation that would vest and would be payable in the event of the executive’s death; |

| · | Voluntary Termination by Executive Without Good Reason: an executive who resigns in this manner receives no severance compensation and the executive’s unvested long-term incentive stock compensation is forfeited; |

| · | Termination Without Cause or Voluntary Termination by Executive With Good Reason Following aChange in Control: an executive terminated in this manner receives a payment equal to a multiple of the executive’s current base pay and average bonus over the prior three-year period. Mr. Nassetta is entitled to three times his current base salary plus three times his average bonus. All other members of senior management covered by the plan are entitled to two times their current base salary plus two times their average bonus. All long-term incentive stock compensation vests, and the Company will pay for the executive’s benefits under the Company’s standard benefit plans for 18 months or until the executive is re-employed, whichever time period is shorter. These provisions remain in effect for a period of one year following a change in control of the Company; and |

| · | Termination Without Cause or Voluntary Termination by Executive With Good Reason Not Followinga Change in Control: an executive terminated in this manner receives a payment equal to a multiple of the executive’s current base pay and average bonus over the prior three-year period. Mr. Nassetta is entitled to two times his current base salary plus two times his average bonus. All other members of senior management covered by the plan are entitled to a payment equal to their current base salary plus their average annual bonus. One year’s worth of the executive’s time-based and performance-based portions (assuming achievement of target performance goals) of long-term incentive stock compensation is subject to accelerated vesting, and the Company will pay for the executive’s benefits under the Company’s standard benefit plans for 18 months or until the executive is re-employed, whichever time period is shorter. |

The plan also provides for a one-year non-compete/non-solicitation period and allows each executive a period of one year after termination to exercise any options to which the Chief Executive Officer/President, as applicable.

executive may be entitled due to the accelerated vesting of long-term incentive compensation. The Company intends to seek qualification of the cash and benefit provisions of the Severance Plan under the Employee Retirement Income Security Act of 1974.

18

REPORT OF THE COMPENSATION POLICY COMMITTEE

ON EXECUTIVE COMPENSATION

To Our Shareholders

Stockholders:

The Compensation Policy Committee of the Board of Directors oversees and administers theour executive compensation program on behalf of the Board and, by extension, our shareholders.stockholders. This report provides details and background information regarding the executive compensation program.

The Committee

The Compensation Policy Committee is composed of fourtwo independent members of the Board of Directors. It approves theour executive compensation programs, and

policies and sets performance targets, and then evaluates the performance of our Company and its senior management.executive officers. The Committee met fourthree times during 2001. R. Theodore Ammon was a member of the Committee until his death in

October 2001, and J.W. Marriott, Jr. was a member of the Committee until

January 2002. Neither Mr. Ammon nor Mr. Marriott was a member at the time the

Committee made the decisions on executive compensation discussed below.

Goals of the Program

The Committee has established three primary objectives for the executive compensation program:

. to provide annual and long-term incentives that emphasize

performance-based compensation dependent upon achieving corporate and

individual performance goals;

. to foster a strong relationship between shareholder value and executive

compensation programs by having a significant portion of compensation

comprised of equity-based incentives; and

. to provide overall levels of compensation that are competitive in order

to attract, retain and motivate highly qualified executives.

| · | to foster a strong relationship between stockholder value and executive compensation programs by having a significant portion of compensation comprised of equity-based incentives; |

| · | to provide annual and long-term incentives that emphasize performance-based compensation dependent upon achieving corporate and individual performance goals; and |

| · | to provide overall levels of compensation that are competitive in order to attract, retain and motivate highly qualified executives to continue to enhance long-term stockholder value. |

Competitiveness Targets